ECONOMY | 28.11.2011

Eurozone faces recession, says OECD

The Organization for Economic Cooperation and Development (OECD) has sounded the alarm in its latest economic growth outlook, published in Paris on Monday. It sees the eurozone's debt crisis as the primary risk for the global economy.

"If not addressed, recent contagion to countries thought to have relatively solid public finances could massively escalate economic disruption. Pressures on bank funding and balance sheets increase the risk of a credit crunch," the forum said in its news release.

Strengthening EFSF and ECB

"Prospects only improve if decisive action is taken quickly,” OECD Chief Economist Pier Carlo Padoan said on Monday.

"The risk of contagion needs to be stemmed through a substantial increase in the capacity of the European Financial Stability Fund, together with a greater ability to call on the European Central Bank's balance sheet," he added.

He insisted that those steps must go hand in hand with "governance reforms to offset the risk of moral hazard."

US danger

The OECD is also worried about the global impact of the economic situation in the US, if Washington does not find a way to mitigate a fiscal savings program that is set to come into effect from 2013.

Failure to act "could tip the economy into a recession that monetary policy can do little to counter," the OECD warned, adding that the US needed a convincing financial action plan if its economy is to grow. Only then would growth of 2 percent be a realistic scenario, according the organization.

Eurozone recession

The OECD paints a grim picture of growth in the eurozone. The economies of its 17 member states are likely to shrink in the next two quarters, before bouncing back in the second quarter of next year.

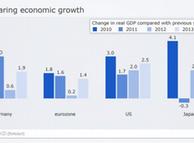

For 2012, the OECD's economists forecast growth of just 0.2 percent for the whole of the eurozone, with crisis-stricken countries like Italy likely to suffer a 0.5 percent drop in gross domestic product (GDP).

Portugal may fare even worse, its economy could contract by 3.2 percent, and Greece could see GDP drop by 3 percent.

Limited effect on Germany

The German economy, on the other hand, is unlikely to experience a prolonged downturn, according to the OECD. After a brief phase of anemic growth, it is set to bounce back from mid-2012 onwards.

"Growth rates may then rise above potential from around mid-2012, given the absence of underlying imbalances in household and corporate balance sheets," the report said.

The OECD expects German GDP to grow by 0.6 percent next year and by 1.9 percent in 2013. This year, it will manage to rise by 3 percent.

Germany's labor market is also set to continue its recovery, with only 2.7 million people projected to be out of work in 2013 - 200,000 fewer than this year.

Authors: Henrik Böhme, Nicole Goebel (Reuters, dapd, dpa, AFP)

Editor: Michael Lawton

Editor: Michael Lawton

dw

No comments:

Post a Comment