EUROPE | 20.07.2011

Greece has to default, says Nobel Laureate

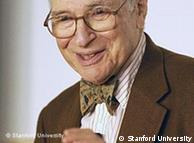

Kenneth J. Arrow is professor of economics emeritus at Stanford University and winner of the Nobel Prize for Economics in 1972. He is the youngest Nobel Laureate to have been awarded the prize in economics. Arrow also served on the White House Council of Economic Advisers under President John F. Kennedy.

In Europe a major economic crisis has been unfolding for months. It first focused mainly on Greece going bust, but has snowballed to Italy, Spain, Portugal and Ireland and now threatens Europe's entire economic system. How dangerous is the situation in Europe?

My impression is in effect Greece has to default on its debt. It's being paid for now by other European countries, Germany and France, and that's not sustainable. They are simply going to have to default in some form or restructure or whatever nice language you want to use. I have the impression, but maybe my sense of magnitude is wrong, but Greece and Portugal are really not that big.

Default of these bonds would simply mean that a bad debt is recognized as a bad debt. The banking system of Europe holding these bonds doesn't contain that many of them and my impression is that the financial system will simply have to absorb the losses and probably can do so.

Now Spain is a different matter and Italy is an even bigger matter. I see the Italian parliament has in fact stepped up to the plate and I don't know if it really is as good as it sounded in American newspapers, but they claim to be aiming for a balanced budget in two years. It seems to me that the Italians have recognized the situation and are moving to address the problem. My impression of Spain is that it has not at all been running a profligate policy. Spain's public finances are actually by no means in bad shape, but their economy is in very bad shape.

You have the problem that was recognized with the creation of the Eurozone that you have a unified monetary policy, but don't have a unified fiscal policy.

Some have the impression that if there was a political union Greece wouldn't have this problem. But in fact here in the US we don't bail out our states. California has been on the edge for a long time, New York has been on the edge for a long time. But there is no suggestion that the United States assume California's debt. If California defaults, it defaults. So the idea that Greece debt should be guaranteed by some sort of consortium of European countries is not necessarily correct. Let them default. The failures are there. So the only real question is, are you going to recognize them on the banks books. And it seems to me that Europe is rich enough to absorb that.

European leaders have for months been trying to resolve the crisis, but things have only deteriorated. How would you rate the economic crisis management of Europe's leaders?

Not very impressive. The real sign of a well-working system is that these things are anticipated and smaller amounts done quietly and without a lot of negotiations earlier on. That could have made a big difference. It's truly a lack of a central political leadership. The prosperous lending countries are negotiating with each other who can take the burden. They have different domestic political constraints. So it's a little different from a having a central government and that's probably part of the problem. But the history of Europe since World War II is extraordinarily good and Europe has managed things very well, largely by cooperation among the leading countries, mainly France and Germany. And I have the feeling that's beginning to fall apart.

Are you worried that this economic crisis could really unravel the European project that was begun after World War II?

I don't think it's going to unravel it, but further progress certainly doesn't seem to be on the cards. This has been going on for some time as the rejection of the treaty of Lisbon showed. In a sense the cooperation that marked the European project was partly based on the concept that we are going to go even further in the future. And when you stop, some of the national differences begin to become more apparent. I suppose in retrospect the expansion of the European Union was too rapid.

What advice would you give European leaders how they can resolve the crisis?

You have to allow the market to operate to some extent which gets the burden of political decision-making off the backs of the leaders. The idea of avoiding all defaults is in my mind an unsustainable ideal. And probably some kind of recognition that you need joint action and some new entity which will try to anticipate problems and handles them a little more quietly is I think essential, because a lot of these problems would not be so big if they were handled right. That's my advice for whatever its worth.

Looking at the long-range perspective for Europe, do you think the EU can be viable as a global player in the future if it isn't integrated both politically and economically?

Milton Friedman was opposed to the Eurozone idea on these grounds. It's too diverse a group, it's not a single economy for a uniform monetary policy. But I think it's irreversible. I think you have to try to handle it. I think these things are manageable. There are problems, but they are manageable if there is enough goodwill. And it is in the interest of the leading countries to lend some sort of support and they have been, but I think some of the burden has to fall on the countries themselves.

Interview: Michael Knigge

Editor: Rob Mudge

Editor: Rob Mudge

dw

No comments:

Post a Comment